In today’s fast-paced financial landscape, individuals and businesses are searching for reliable partners to guide them through complex decisions. Monarch Finance is one such company that has risen to the occasion, offering tailored solutions that meet immediate financial needs and provide long-term growth strategies. But what exactly is Monarch Finance, and how does it stand out in the competitive world of financial services?

What is Monarch Finance?

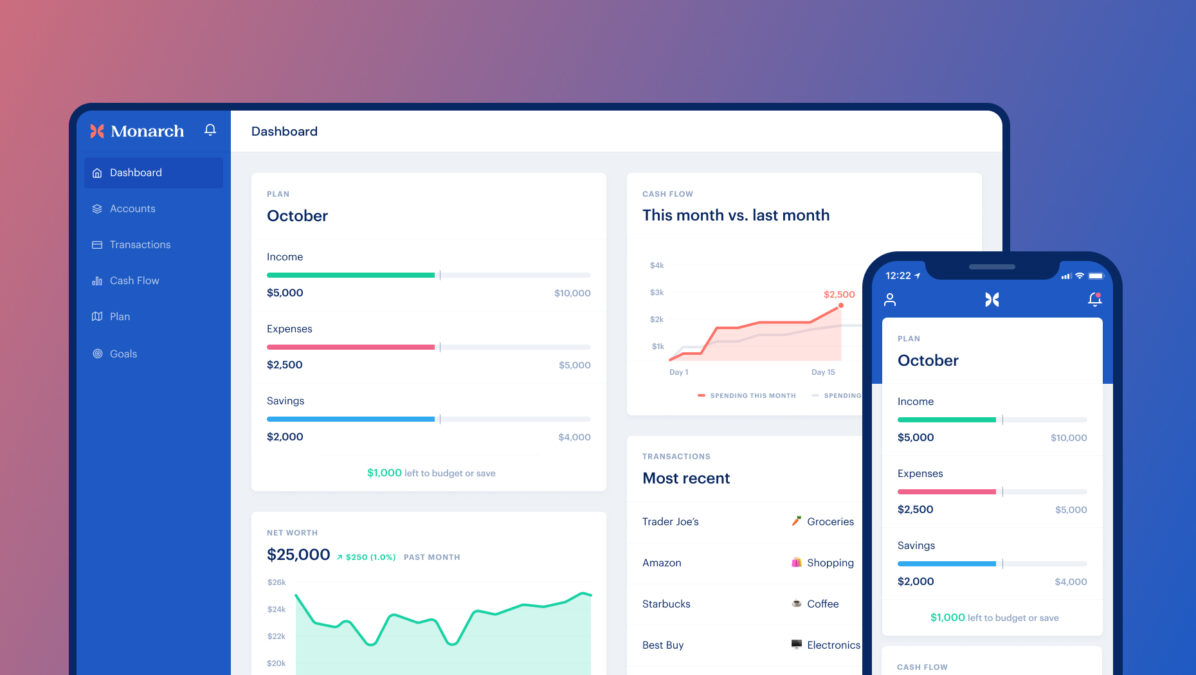

It is a financial services firm specializing in personal and business financial management. With a team of experienced professionals, It is dedicated to providing customized solutions to help clients navigate the intricate world of finance. The company offers various services, including investment advice, financial planning, business consulting, and more.

Founded on trust, transparency, and reliability principles, Monarch Finance has earned its reputation as a leader in the financial services industry. Whether you’re an individual looking to secure your financial future or a business in need of strategic financial guidance, Monarch Finance provides the tools and expertise needed to achieve your goals.

Why Choose Monarch Finance?

There are plenty of financial service providers, so what makes Monarch Finance different? Here are a few reasons why clients choose It for their financial needs:

Expertise and Experience

Monarch Finance boasts a team of seasoned financial professionals with decades of experience in various financial industry sectors. The team brings a wealth of knowledge in investment management, retirement planning, tax strategies, and business consulting. This expertise allows Monarch Finance to provide effective solutions aligned with each client’s unique financial situation.

Tailored Solutions

Unlike one-size-fits-all financial firms, It takes the time to understand each client’s needs. Whether you’re a retiree seeking income security, an entrepreneur looking for business growth strategies, or a family planning for future education costs, Monarch Finance works with you to create a personalized plan that helps you meet your objectives. Every recommendation and strategy is customized, ensuring you receive the best financial guidance.

Transparency and Integrity

One of the core values of Monarch Finance is transparency. Clients are kept informed at every stage of the process, ensuring that they understand the choices being made on their behalf. It adheres to a strict code of integrity, putting clients’ needs above all else. This transparency fosters trust, allowing clients to make informed decisions with peace of mind.

Key Services Offered by Monarch Finance

It provides a wide range of services catering to individuals and businesses. Some of the key offerings include:

Personal Financial Planning

Personal finance can be overwhelming, especially when unsure where to start. This offers comprehensive financial planning services to help individuals manage their finances more effectively. This includes:

- Retirement Planning: Ensuring that clients have a stable income after they retire, with a strategic mix of investments, savings, and retirement accounts.

- Tax Optimization: Monarch Finance helps clients reduce their tax liabilities through strategic planning and investment choices that minimize taxes.

- Education Savings Plans: With the rising education costs, Monarch Finance offers solutions to help families save for future educational expenses.

Business Financial Services

For business owners, managing finances can be just as complex. Monarch Finance understands these challenges and provides services tailored to meet the needs of businesses, both small and large. Some of their business-related services include:

- Cash Flow Management: Helping businesses track income and expenses, ensuring they have the capital to grow and expand.

- Tax Planning and Strategy: This works with businesses to minimize tax burdens while complying with tax laws.

- Investment Guidance: Assisting companies with strategic investments that enhance growth and protect against financial risks.

Investment Services

Investing wisely is one of the most effective ways to build wealth over time, but the world of investments can be complex and intimidating. Monarch Finance offers investment advisory services that cater to different risk profiles and financial goals. It has the tools and expertise to guide you whether you want a conservative approach or more aggressive investment strategies.

Monarch Finance’s Approach to Risk Management

One of the key aspects of financial planning is managing risk. Monarch Finance understands that every investment carries some level of risk, but not all risks are equal. Their team works diligently to assess the risks associated with each client’s financial plan and then develops mitigation strategies.

Diversification

A common way to reduce risk is through diversification. Monarch Finance encourages clients to spread their investments across different asset classes, industries, and geographic regions. This approach helps to minimize the potential negative impact if one particular investment underperforms.

Insurance Solutions

In addition to investment strategies, It offers insurance products to protect clients from unforeseen events that could derail their financial plans. Whether life insurance, disability coverage, or health insurance, Monarch helps individuals and families safeguard their wealth against unexpected situations.

Emergency Funds

Another key risk management strategy is ensuring clients have sufficient emergency funds to handle life’s uncertainties. Finance advises clients on how much they should save for emergencies and how to set up an emergency fund that is easily accessible when needed.

Success Stories: How Monarch Finance Makes a Difference

The true measure of a financial firm’s success lies in the success of its clients. Monarch has helped hundreds of individuals and businesses achieve their financial goals, and here are just a few of their success stories:

- Personalized Retirement Solutions: A couple in their mid-50s came to Monarch Finance seeking help planning retirement. Monarch developed a tailored strategy that included a mix of retirement accounts and tax-saving investments, allowing the couple to retire comfortably at age 65 with an adequate income stream.

- Business Growth Strategies: A small business owner struggled struggling flow and uncertain financial planning. Monarch Finance worked with them to create a budget, develop a cash flow plan, and identify investment opportunities. The business has since seen significant growth and profitability.

- Education Savings: Monarch helped a family set up a tax-efficient education savings plan to fund their children’s college education without the financial strain many families face.

The Future of Monarch Finance

As Monarch Finance continues to grow, the company remains committed to staying at the forefront of financial services innovation. With the increasing complexity of financial markets and the ever-changing economic landscape, Monarch Finance is constantly adapting its services to meet clients’ evolving needs.

Conclusion: Partnering with Monarch Finance for Financial Success

In conclusion, Monarch Finance is more than just a financial services firm – it’s a trusted partner that empowers clients to achieve their financial dreams. With a commitment to expertise, personalized solutions, transparency, and integrity, Monarch stands out as a leader in the industry. Whether you’re an individual looking for retirement planning or a business seeking strategic financial guidance, Monarch Finance has the experience and resources to help you succeed. By partnering with Monarch , you take the first step towards a more secure and prosperous financial future.